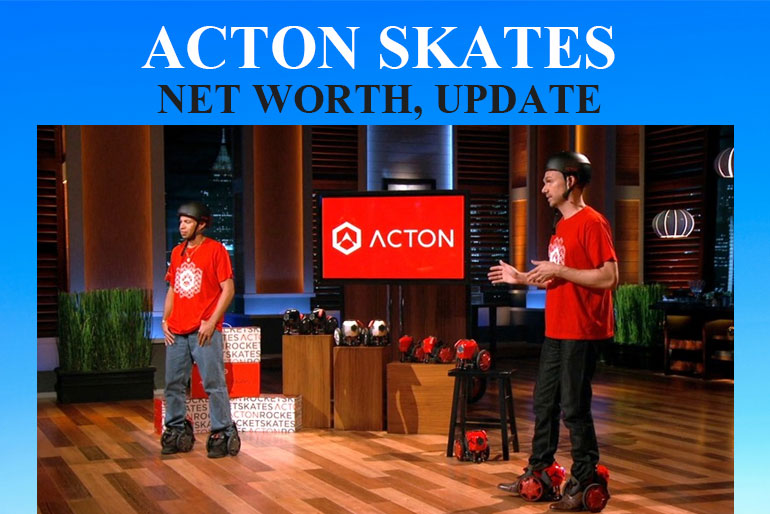

In September 2015, inventor-designer Peter Treadway glided through the big warehouse doors wearing a pair of battery-powered “Rocket Skates.” The Season 7 premiere was buzzing: guest shark Ashton Kutcher was on the panel, the lights were bright, and viewers had never seen personal electric skates that strapped right over regular shoes. Peter’s goal was simple—help city folks zip past traffic without breaking a sweat.

The ask that raised eyebrows

Peter requested $1 million for 3.5 percent equity, implying a valuation just shy of $29 million. The sharks liked the sleek design and the 20-plus patents but balked at the price tag. Only Kevin O’Leary countered—$1 million for 15 percent. Peter held firm, negotiations stalled, and he rolled out without a deal.

Why the skates were intriguing

Rocket Skates could hit about 12 mph and travel up to 10 miles per charge. They responded to subtle foot motions instead of a handheld remote, and a companion phone app tracked mileage, battery life, and even “paired” riders so friends could cruise together. Retail prices ranged from $499 to $699, with roughly 40 percent going toward manufacturing costs. Sales had reached $1 million in 2014 and were pacing toward $2 million for 2015.

Immediate reactions in the Tank

Robert Herjavec strapped on a pair for a quick demo but struggled to stay balanced; Ashton Kutcher felt the learning curve and price would scare off casual riders. Lori Greiner sensed Peter was holding back passion, while Mark Cuban probed for clearer financials. In plain English: the skate concept was cool, but the business case felt wobbly.

Life after the cameras

Walking away without capital might sound bleak, yet Acton kept rolling. By late 2015 the company closed an additional $2.5 million round at a $20 million valuation, then steadily broadened its catalog to include electric scooters and a fold-up “M-Scooter.”

Rebranding to Acton Global

As real-world testing revealed that skates were a niche hobby, Peter pivoted toward micromobility for the masses. In 2018 the firm quietly rebranded as Acton Global, signaling bigger ambitions: smart e-bikes, shared scooters, docking stations, and fleet-management software for cities and campuses. The Rocket Skates line was discontinued in 2024, freeing engineering hours for vehicles ordinary commuters could master in minutes.

Key growth benchmarks

- 2021 revenue: 6 Million from B2B fleet deals and direct vehicle sales.

- 2024 valuation: industry analysts and investor databases peg Acton Global at about $50 Million.

- Global footprint: products or infrastructure in 100-plus cities on five continents.

These figures place Acton firmly in the mid-tier of micromobility start-ups—not a unicorn, but a serious player with recurring municipal contracts.

The Duckt acquisition that changed the game

To solve a common headache—where do riders park and charge e-bikes?—Acton bought DUCKT in early 2022. Duckt specialized in modular docks that charge scooters and lock bikes with a single click. Folding Duckt’s hardware into Acton’s vehicle lineup turned the company into an end-to-end provider: vehicles, docks, cloud software, and city-level analytics all under one roof.

What “net worth” means for Acton

Because Acton is privately held, “net worth” refers to its enterprise valuation—the price investors would likely pay for the whole business if a sale occurred today. Multiple sources converge around $50 million as of early 2025, based on comparable deals in the micromobility space and the size of Acton’s fleet contracts. Keep in mind that figure isn’t cash in the bank; it blends asset values, revenue multiples, and goodwill from patents and software IP.

Current products and services (2025 snapshot)

| Category | Example | Who buys it? | Why it sells |

|---|---|---|---|

| Smart e-bike (Nexus Fleet) | 25 km/h top speed, swap-ready battery | City agencies, universities | Low-maintenance design, real-time GPS diagnostics |

| Ride-share scooter (NEO-S) | 40 km range, swappable battery | Third-party operators | Quick charging, anti-theft locking hubs |

| Docking & Charging Station | 4–12-port modular bays | Municipalities | Reduces sidewalk clutter, charges vehicles in < 3 hrs |

| Cloud Platform | Web dashboard + open API | Fleet managers | Tracks usage, maintenance needs, CO₂ savings |

(all specs pulled from Acton’s public product sheets, 2024-25)

Challenges that haven’t vanished

- Capital-intensive hardware: Manufacturing still demands large purchase orders before revenue rolls in.

- City regulations: Micromobility is booming but also faces bans, speed caps, and parking rules that shift by region.

- Competition: Giants like Lime, Bird, and local upstarts claw for contracts, pushing margins down.

Lessons from the Rocket Skates era

- Listen to user feedback early. Casual riders wanted something easier than powered skates; Acton responded by pivoting.

- Valuation realism matters. The sharks’ skepticism over a $29 million ask turned out to be a useful market filter, nudging Peter toward a more sustainable growth path.

- Own more of the stack. Buying Duckt allowed Acton to offer a soup-to-nuts solution, differentiating it from “vehicle-only” rivals.

Founder spotlight

Peter Treadway, trained in industrial design, remains Chief Innovation Officer. He’s no longer the public face zipping around in prototype skates; instead, he sketches new sensor layouts and battery enclosures behind the scenes. Friends say he still rides a prototype e-bike on the streets of San Francisco, gathering real-world data the old-fashioned way.

The road ahead

Acton’s 2025 roadmap hints at:

- Solar-powered docking canopies to cut grid energy use.

- Cargo e-bikes for last-mile delivery companies, tapping the explosive growth in same-day shipping.

- AI-assisted fleet balancing that predicts where bikes should be re-deployed each night, reducing idle time.

If these plans stick, revenue could expand beyond $10 million annually within two years—a healthy leap, though still modest compared with billion-dollar mobility giants.

Final thoughts

Acton’s story underscores a timeless startup truth: the first product isn’t always the final destination. Electric skates earned the spotlight, but it was the pivot to practical, shared vehicles that unlocked real scale. Today the company stands worth roughly $50 million, operates in over 100 cities, and owns a hardware-plus-software platform broad enough to survive the micromobility shakeout. That journey—from strapping motors onto shoes to wiring whole street corners for charging—may not have dazzled the sharks, but it’s paying off for riders who simply want a quicker way around town.