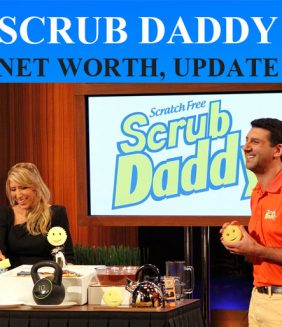

If you’ve ever looked at your dog’s bed and thought, “Honestly… I want one,” Plufl is the business that ran with that exact feeling. The founders turned a viral idea into a national moment on Shark Tank and then into a real company with real sales—and some very real challenges. Here’s the simple, no-fluff breakdown of Plufl’s net worth and what’s happened since their Season 14 appearance.

Quick Version

- What it is: A giant, human-sized “dog bed” designed for napping and lounging. Think plush bolsters, a thick cushioned base, and a removable, washable cover.

- Who founded it: Noah Silverman and Yuki Kinoshita, university buddies who developed the concept while completing their studies at the University of British Columbia in 2022.

- Shark Tank visit: Season 14, Episode 5 on October 21, 2022. They requested $200,000 in exchange for 10% and received an on-air offer from Mark Cuban and Lori Greiner: $200,000 for 20%.

- Early results: By late 2022 they’d hit about $1 million in revenue and rode a tidal wave of TikTok attention.

- 2023–2024 updates: They expanded fulfillment, shifted to faster shipping by August 2023, and at one point dropped the list price to about $350, with total 2023 sales over $1 million.

- 2025 headwind: A steep U.S. tariff on certain China imports in April 2025 pushed Plufl to weigh U.S. manufacturing, which they said would make prices too high for customers.

What Plufl actually sells (and why people love it)

Plufl took the best parts of a pet bed and upsized them for people: bolstered sides to hug into, a deep cushioned base you can sink into, and a soft, washable cover. Reviewers describe it as a cross between a memory-foam mattress, a giant bean bag, and a cozy throw—basically a dedicated nap zone you can drag anywhere.

The concept went viral on social media in 2022. That hype turned into orders, and then into a TV pitch. By the time they were on Shark Tank, the founders had already built meaningful traction for such a quirky product.

Shark Tank: the moment that changed everything

Plufl appeared in Season 14, Episode 5 (aired October 21, 2022). They asked the sharks for $200,000 for 10%. After some back-and-forth, Mark Cuban and Lori Greiner offered $200,000 for 20%, which the founders accepted on air. That deal implies a $1 million on-air valuation at the time (because $200k is 20% of $1M).

During the pitch, pricing and costs were a big topic: the bed retailed around $399, with roughly $140 in unit cost. It wasn’t cheap to make, and the sharks wanted to know if the margins would hold as the company scaled.

The first year after TV

The “Shark Tank effect” is real. By late 2022, Plufl had already hit about $1 million in revenue, helped by massive TikTok reach.

Operationally, the team worked to speed up delivery. By August 2023, they’d transitioned to immediate shipping (a big improvement for a bulky, specialty product) and even reduced the price to around $350 at one point to drive conversion. A frequently cited recap also notes more than 3,000 units sold in the early run.

For 2023, reporting indicates over $1 million in sales, with products available both on their own site and on Amazon.

2024–2025: Growth meets reality

It wasn’t all smooth sailing. In April 2025, a new 145% tariff on some Chinese imports came crashing down. For a big, foam-dense product, a tariff that high can wipe out margins or necessitate an ugly price increase. Plufl’s founders said they explored shifting to U.S. manufacturing, but the costs would likely push the retail price to a level customers wouldn’t accept.

This is a classic direct-to-consumer challenge: you can find product-market fit, dial in marketing, and then get blindsided by supply chain changes you can’t control. In 2025, Plufl had to navigate that new reality while keeping the product affordable enough for casual loungers (not just luxury impulse buyers).

So… what’s Plufl’s net worth?

Short answer: there’s no official public number. Plufl is a private company, and private companies don’t have to publish their valuation. But we can build a reasonable estimate using publicly reported facts plus common-sense assumptions.

- Baseline from Shark Tank (late 2022): They accepted $200,000 for 20% on air. That implies a $1 million post-money valuation at that time. This is the cleanest anchor we have.

- Sales traction through 2023: Reporting points to over $1 million in 2023 sales. Consumer DTC/home brands in this niche are often valued anywhere from 1× to 2× annual revenue (more if growth and margins are exceptional, less if operations are bumpy). That rough yardstick would put a late-2023/early-2024 valuation in the $1–$2 million neighborhood. It’s a wide range, but it reflects typical multiples for a young physical-goods brand. (Sales info: $1M+ for 2023.)

- Tariff shock in 2025: The April 2025 tariff significantly raised landed costs for China-sourced goods. If Plufl’s unit economics got squeezed, investors would likely apply a lower multiple or wait to see whether the company could shift suppliers or pricing. That doesn’t mean the brand is in trouble; it just means valuation growth could pause or tighten until the cost structure stabilizes.

Putting it all together (as of August 2025):

- Floor: The on-air $1 million post-money valuation from 2022 gives a historic baseline.

- Ceiling (pre-tariff): If we applied a simple 1–2× revenue lens to 2023’s $1M+ in sales, you could argue for $1–$2 million.

- Today’s estimate: Given 2025’s tariff pressure, a conservative present-day range would likely cluster near the low-to-mid seven figures—in plain English, about $1–$2 million, unless they’ve since cut costs, raised prices without hurting demand, or launched profitable add-ons at scale. That range is a reasoned estimate, not a confirmed figure, because Plufl hasn’t publicly announced new financing or a formal valuation.

If you see blogs throwing out higher “net worth” numbers, treat them as speculation unless they cite fresh, verifiable sales or funding data. The best-grounded public facts right now are: the $1M on-air valuation in 2022, $1M+ 2023 sales, and the 2025 tariff headwind.

Product details, pricing, and what changed

- Things consumers care about: plush bolsters, dense cushioned base, washable/removable cover. These things matter because they make a premium price reasonable and make the bed feel more like furniture than a fad.

- Price history: Around the pitch, the retail price discussed was about $399, with costs around $140. In 2023 they were seen around $350 at times.

- Sales channels: Their own site plus Amazon helped push 2023 sales over $1 million.

The founders and origin story

Noah Silverman and Yuki Kinoshita built Plufl during their final year at the University of British Columbia in 2022. The spark: a massive dog bed at a campus coffee shop that looked absurdly comfortable. One viral video later, the concept took off, and instead of accepting traditional consulting jobs, they jumped into e-commerce full-time.

Where Plufl is now

- Operations: They scaled fulfillment and shortened delivery times by August 2023, which helped them handle demand spikes more smoothly.

- Sales: 2023 cleared $1M+, a solid show-of-life for a niche comfort product.

- Challenges: 2025 tariffs forced hard choices on manufacturing strategy and pricing. The company said a full U.S. build would hike prices beyond what their customers would accept, so they’ve been navigating alternatives.

What could move the valuation next

- Sourcing wins: If Plufl locks in a non-tariffed supplier (or negotiates lower costs elsewhere) without hurting quality, margins improve and a higher valuation gets easier to defend.

- Product line expansion: Accessories or new sizes that reuse core materials and brand equity can lift average order value and repeat purchases. (Their core design already lends itself to add-ons like covers.)

- Retail partnerships: Wider distribution, if profitable, would reduce reliance on social ads and help smooth seasonality. 2023 sales via Amazon suggest the brand isn’t limited to its own site.

- Price/positioning: If customers accept a higher price due to tariffs—or if Plufl introduces a lower-cost “lite” option—valuation could change accordingly.

Final take

Plufl pulled off something rare: they turned a playful idea into real revenue, national attention, and a brand people instantly recognize. As of August 2025, the most grounded way to talk about their net worth is to reference the $1M on-air valuation from 2022, the $1M+ in 2023 sales, and then account for the 2025 tariff squeeze that likely keeps the current value in the low-to-mid seven figures until the cost side improves. In simple terms: roughly $1–$2 million today, unless new data says otherwise. That’s not a knock—it’s a realistic snapshot for a young, single-product DTC brand tackling a tricky supply chain moment.